Introduction

Access to electricity is critical to the improvement of socioeconomic development indicators concerning poverty eradication, access to food, better health care, quality education, clean water and sanitation, good housing and infrastructure, economic development, gender empowerment, environment protection, and climate change. In 2011, the United Nations (UN) launched a Sustainable Energy for All (SEforALL) initiative to achieve three ambitious objectives by 2030: (1) ensuring universal access to affordable, reliable, and modern energy; (2) doubling the share of renewable energy (RE) in the global mix; and (3) doubling the global rate of improvement in energy efficiency (United Nations, 2014). Subsequently, in 2015, the UN adopted the SEforALL objectives as the seventh goal of its 17 sustainable development goals in the global 2030 agenda to socially and economically improve the human condition and protect the planet (SEforALL, 2016; United Nations Development Programme, 2016).

As of 2016, about 590 million people in Sub-Saharan Africa (SSA) had no access to electricity, and about 780 million people depended on the traditional use of solid fuels for cooking (IEA, 2017a). The IEA report shows that there are even more people in SSA without electricity now than there were in the year 2000 (518 million). The average annual electricity consumption per capita for SSA (excluding South Africa) is also very low; less than 200 kWh (IEA, 2015). Overall, the current generation capacity and the transmission and distribution network are inefficient, with losses higher than the world’s average of 7 percent (Africa Progress Panel, 2017). In addition, corruption, poor management, theft, and vandalism aggravate the problematic power situation in Africa (Africa Progress Panel, 2017). All of these energy bottlenecks and power shortages are estimated to cost Africa 2 to 4 percent of gross domestic product (GDP) annually (African Development Bank, 2017b).

Nevertheless, the SSA region is endowed with sufficient RE resources (solar, hydro, wind, bioenergy, and geothermal) to electrify every home, community, school, and hospital while powering agricultural activities, industries, and businesses. Estimates show that SSA has about 10 TW of solar, 350 GW of hydro, 109 GW of wind, and 15 GW of geothermal potential electricity generation capacities (Castellano et al., 2015a, 2015b). Other non-RE potential capacities include 400 GW of gas-generated power and 300 GW of coal. Thus, there is an enormous investment opportunity for aggressive development of modern energy technologies to harness the resources available in SSA to reduce energy poverty and stimulate economic growth (International Energy Association [IEA], 2014; International Renewable Energy Agency (IRENA), 2015).

In addition, there seems to be enough political will from the international community and African leaders to catalyze the rapid development of Africa’s power sector and ensure that all inhabitants of the subcontinent have access to basic electricity. Many regional and global initiatives have been formed to mobilize financial support and the private sector to tackle the monumental challenge of energy poverty. These include SEforALL (SEforALL, 2016), Power Africa (USAID, 2016, p. 2017), the New Deal on Energy for Africa (African Development Bank, 2017b), Energy Africa Campaign, and the Sustainable Energy Fund for Africa (SEFA) (SEFA, 2016; Small Enterprise Finance Agency (SEFA), 2015). Other major regional initiatives are Africa Renewable Energy Initiative (AREI, 2016), the Programme for Infrastructure Development in Africa (PIDA) (African Union Commission, 2010), the Africa Power Vision (APV) (New Partnership for Africa’s Development (NEPAD), 2015), The African Energy Leaders Group, and the African Union’s Agenda 2063 (African Union Commission, 2015). Importantly, some African leaders and policymakers have started intensifying efforts to tackle numerous regulatory and political barriers to unlock the potential of the continent’s renewable sources of energy. The recent launch of the African Platform for National Determined Contributions Hub at the 2017 United Nations Climate Change Conference (COP23) underscores African countries’ commitment to tackle climate change by providing access based on renewable sources.

Furthermore, several emerging “disruptors” have begun shaping the landscape of SSA’s power-sector future. For example, the number of independent power projects with long-term power purchase agreements is rapidly increasing across the region (Eberhard et al., 2016). Moreover, the dynamics of energy services are changing, particularly in the rural parts of the region, because of the advent of disruptive off-the-grid programs and use of decentralized power systems. At the same time, the cost of renewable energy technologies continues to plummet and is becoming competitive with fossil fuels. Additionally, initiatives on energy access are improving the investment climate and mobilizing private-sector investments as well.

With the recent political willingness, declining cost of non-hydro renewables, improved financial climate, and new dynamics in the energy market, energy access is expanding. Therefore, it is critical to keep track of the development activities in SSA to gauge progress toward universal access in the subcontinent. In general, the SEforALL, through its Global Tracking Framework, is at the forefront of tracking global progress toward the initiative’s three pillars by 2030. The global report focuses on the progress toward ensuring universal access; doubling the share of RE in the global mix; and doubling the global rate of improvement in energy efficiency (Global Tracking Framework [GTF], 2017; World Bank & International Energy Agency, 2015). Nevertheless, in light of the scale of the challenge of energy access in SSA, more focused and in-depth coverage of the subcontinent is needed. Therefore, this review paper seeks to complement other reports in the field of electrification in the Sub-Saharan region. Specifically, the paper’s objective is to contrast the progress made between 1990 and 2010 with recent progress to identify and capture improvement in electricity access, installed capacity, electricity generation, the growth of renewable energy, and electricity consumption in SSA. The paper also identifies at the sub-regional level which countries are lagging on electricity access and use of sustainable renewable power to inform power system planning in SSA. In addition, the paper reviews some of the major energy access initiatives in the subcontinent. Overall, the paper provides useful information for advocates and policy- and decisionmakers to evaluate, calibrate, and amend strategies and efforts to electrify SSA at a pace needed to attain universal electricity access by 2030.

Methodology

The paper focuses exclusively on electricity and not on other energy service provisions (e.g., heating and cooking). Detailed discussion of decentralized technologies is beyond the scope of this paper. The analysis presented in this paper is based on databases from the World Bank (World Development Indicators), the US Information Administration, the International Renewable Energy Agency (IRENA), and the UN Population Division. Table 1 summarizes the data sets that were employed for the study. Each data set was evaluated for 49 countries in SSA, including island nations. Table 2 shows the list of countries and sub-regions as referred to in this study. Equations 1–5 define the population with access, the population without access, installed capacity per capita, gross consumption per capita, household consumption, and share of renewable energy in the generation mix.

Population with access=Access (%)∗Population100

Population without access=((100−Access(%))∗Population100

Installed capacity per capita=Total installed capacityPopulation

Gross consumption per capita=Annual electricity consumptionPopulation

Household consumption=Residential electricity onsumption(Population with accesshousehold size)

Share of renewable electricity=Generation from renewable energyTotal electricity net generation

Government Investment on Electrification

SSA’s power sector is underdeveloped compared with the rest of the world in terms of the installed capacity, electricity generation, transmission, and distribution. This reflects African governments’ low infrastructure investment and lack of energy planning. Data from 24 African countries show that public capital spending on infrastructure was about 2 percent of GDP between 2009 and 2015, of which 15 percent (that is, 0.3 percent of GDP) was for electricity (World Bank Group, 2018). Specifically, it was estimated that the energy-sector investment in 2013 was at US$8 billion per year (0.49 percent of the continent’s GDP) (Africa Progress Panel, 2015). This underscores the fact that the level of government capital spending for power infrastructure is too low in SSA.

The investment problem is compounded by the fact that most of the state-owned electricity utilities are poorly managed and operated at a loss. In SSA, governments spend about US$21 billion per year on utility losses and energy subsidies (Africa Progress Panel, 2015). A report by the International Monetary Fund (IMF) details the extent to which the power-sector utilities are a major fiscal burden in SSA (Alleyne & Hussain, 2013). Figure 1 shows the quasi-fiscal deficit (QFD) as a percentage of 2009 GDP for several countries in SSA. The QFD represents “the difference between the actual revenue charged and collected at regulated electricity prices and the revenue required to fully cover the operating cost of production and capital depreciation” (Saavalainen & Berge, 2006). The QFD varied from as low as 0.3 in Chad to as high as 11 in Zimbabwe. The median QFD for the subcontinent was 1.7 percent (Alleyne & Hussain, 2013). Overall, the QFD captures the extent of distribution line losses, underpricing, and under-collection of bills. Notably, the median QFD burden due to ill-managed utilities is about 4 times higher than the annual infrastructure investment for the energy sector in SSA. If the current power sector is well-maintained and the utilities are managed without a loss, then the funds used to render the inefficient utilities functional could be redirected into productive infrastructure investment and growth.

The lack of fiscal space for investment to address the power-sector challenges and other much-needed infrastructure in SSA could be because of governments’ debt burdens. A report from the World Bank shows that the public debt levels in SSA are on the rise; in 2016, the median government gross debt-to-GDP ratio across the subcontinent was 48 percent (World Bank Group, 2018). The debt burden varies from country to country, as shown in Figure 2. The nations with high debt-to-GDP ratios above the region’s median level include Mozambique, Gambia, and the Republic of Congo. The IMF data show that between 2004 and 2016, the median government’s debt for SSA decreased from 48.2 percent in 2004 to 23.6 percent in 2008 and then increased to 48.0 percent in 2016 (See Figure 3). The decrease observed could be because of initiatives such as Heavily Indebted Poor Countries, Multilateral Debt Relief Initiative and other Bilateral Debt Relief programs that benefited more than half of SSA countries. Most of the countries completed the debt relief programs by 2008 (Merotto et al., 2015), which may explain why an increase was observed afterward. The international economic crisis in 2008 may also have contributed to the increase in the debt-to-GDP ratio. Nonetheless, the World Bank report indicates that the key drivers for the increase in the debt-to-GDP ratios for SSA are exchange rate depreciation, residuals, and the primary deficit (World Bank Group, 2018).

Generally, it is unclear whether African government’s debt burden affects infrastructure expenditure, particularly the expenditures in the power sector shown in the historical (2004–2016) trend chart for SSA’s debt-to-GDP ratio, expenditure of GDP, and electrification rate (Figure 3). Interestingly, the chart does not show an inverse correlation between governments’ debt burden and electrification, which would have indicated that the public debt burden affects governments’ power-sector infrastructure investment. Rather, electrification rates increased with a rise in debt burden from 2008 onwards. In addition, the chart shows that the median expenditure in SSA as a percentage of GDP did not change appreciably; a slight decrease is observable between 2011 and 2016. In some countries, though, the increase in the debt ratios could be because of increase in borrowing to finance infrastructure programs like the Growth and Transformation Plan in Ethiopia. Country-level case studies of Ethiopia and Kenya showed that national governments’ spending on electricity was about 2 to 3 percent of GDP. In both countries, 21 to 24 percent of the finance was domestically sourced (SEforALL, 2017a). Specifically, 79 percent of Ethiopia’s annual average finance was from international sources; most was from China, and 60 percent of it was non-concessional (SEforALL, 2017a). In Kenya, 76 percent of the total annual average financial commitment to all energy access investments was completely concessional (SEforALL, 2017a). Overall, the increase in electrification rates in SSA could be because of an increase in official development assistance–funded energy projects.

International Investment in Electrification

International investment is critical to the scaling up of SSA’s power infrastructure. According to recent energy projects in SSA, only about 25 percent of the required finance is domestically sourced; a significant portion is foreign investments (SEforALL, 2017a). The international financial assistance to SSA’s power sector as of 2015 stood at US$4.9 billion per year (Tagliapietra & Bazilian, 2017). A recent report on the flow of public finance for energy in Africa provides a different overview (Lee & Doukas, 2018). The paper indicates that about US$59.5 billion was invested in energy across the continent between the period of 2014 to 2016, an average of US$19.83 billion per year. Almost 58.9 percent (i.e., US$11.7 billion per year) of the public finance was for fossil fuels (oil, gas, and coal), 18.3 percent was for clean energy projects (mainly solar, wind, and geothermal), 5.5 percent was for larger hydroelectric projects, 10.4 percent was for transmission and distribution networks, and the remaining 6.9 percent was for other projects. Egypt, Angola, and South Africa combined received more than 50 percent of the total public finance investment. Other countries like Kenya, Morocco, Nigeria, and Mozambique received significant public finance over the 3-year period.

Typically, only a small share of these investments goes toward expanding household access to electricity. Estimates indicate that only 31 percent of the financial assistance goes to support new and improved access to electricity for household consumption; a higher share of assistance goes to expand power supply to industries and commercial enterprises (SEforALL, 2017b). Of the public financial flows between 2014 and 2016, only 11 percent of the total investment (i.e., US$ 2.18 billion per year) was tracked to target energy access, with less than 2 percent supporting distributed renewable energy projects (Lee & Doukas, 2018). However, more than 80 percent of the needed capacity to provide universal access to households is projected to come from decentralized technologies (both off-grid and mini-grid systems) (IEA, 2017a).

Among the multilateral and bilateral sources of the public finance, China was the largest provider, followed by the World Bank Group, Japan, Germany, African Development Bank (AfDB), Italy, United States, European Investment Bank, Korea, and France (Lee & Doukas, 2018). Other contributors included the Organization of the Petroleum Exporting Countries (OPEC) Fund for International Development, the Arab Fund for Economic and Social Development, the Kuwait Fund for Arab Economic Development, the government of the United Arab Emirates, the Arab Bank for Economic Development, and the Climate Investment Funds.

An estimated US$55 billion per year must be invested to achieve universal access by 2030 (Africa Progress Panel, 2015; IEA, 2017a). The current international financial assistance and investment from multilateral and bilateral sources is well below what is required to rapidly expand electricity access. More public-private partnership models are needed to help scale up the power-sector investment spending. Several energy access initiatives, including the US Power Africa and the New Deal on Energy for Africa, have been launched to galvanize private investment and expand electricity access in SSA.

Overview of Major Recent Initiatives

There are several initiatives that have been established in recent years to deliver universal access to modern energy services in SSA. Below is a brief review of some of the major active initiatives in the power sector. The objective is to provide an overview of each selected initiative with respect to investment, targets, and recent achievement. The intent is not to provide a holistic review of all the existing programs on energy access in SSA. Table 3 summarizes the initiatives that were reviewed.

SEforALL Initiative

After the launch of the SEforALL initiative in 2011, SEFA was established with US$56 million from the Danish government to enable AfDB to scale up its activities in small- to medium-size renewable energy development and energy efficiency in Africa. Currently, SEFA is a US$95-million multi-donor facility with a financial commitment from Denmark, Italy, UK, and the US (SEFA, 2016). The SEforALL Hub, launched in 2013, was also established to work in close collaboration with AfDB on the SEFA to implement the Agenda 2030. In general, SEFA provides grants and technical assistance resources through three financing components (project preparation, equity investments, and enabling environment) to bring viable projects to bankability. To date, SEFA has committed US$59.97 million of its US$95 million funds across 37 projects in 20 countries, including 9 multinational projects. The project preparation and equity components represent US$1.4 billion in investments and 453 MW of potential installed capacity (SEFA, 2017).

US Power Africa Initiative

In 2013, Power Africa was launched as a partnership among US Government, African nations, bilateral and multilateral development partners, and the private sector to double electricity access in SSA (USAID, 2016). The United States made an initial commitment of $7 billion. Power Africa’s target is to add more than 30 GW of cleaner, more-efficient electricity generation capacity and 60 million new home and business connections by 2030. According to the US Power Africa 2017 annual report, the initiative “has helped facilitate the financial close of 80 private-sector power transactions valued at more than $14.5 billion, that are generating or expected to generate more than 7200 MW” (USAID, 2017). Because of the initiative’s support for private-sector companies and utilities, approximately 53 million people have access to electricity today (USAID, 2017).

AfDB and The New Deal on Energy for Africa

In 2015, the AfDB made energy (light up and power Africa) one of its “High 5” priority areas. The New Deal on Energy for Africa builds upon those goals to accelerate universal access to energy services in Africa (African Development Bank, 2017b). The initiative is a “transformative partnership to light up and power Africa by 2025” (African Development Bank, 2017b). AfDB pledged to invest about $12 billion and leverage between $45 billion and $50 billion in public and private financing for investments in the energy sector to achieve four main targets: (1) adding 160 GW of grid-based capacity, (2) increasing on-grid transmission/distribution to create 130 million new connections, (3) adding 75 million off-grid connections, and (4) increasing access to clean cooking energy for 130 million households. The initiative is guided by five key principles: raising aspirations to solve Africa’s energy challenges; establishing a transformative partnership on energy for Africa; mobilizing domestic and international capital for innovative financing in Africa’s energy sector; supporting African governments in strengthening energy policy, regulation, and sector governance; and increasing the AfDB’s investments in energy and climate financing (African Development Bank, 2017b). The bank also manages the AREI, whose goal is to deliver 300 GW of renewable energy in 2030 and 10 GW by 2020 (AREI, 2016).

Some of the projects under the New Deal include a $1.34 billion syndicated loan in South Africa, transmission/distribution lines to connect 20,000 households to Côte d’Ivoire’s national grid, and electricity to 36 Ethiopian towns and villages. Between 2013 and 2015, the bank’s investments provided 4.2 million people with improved access to electricity and supported the installation of 1470 MW of new electricity capacity, of which 72 MW was renewable (African Development Bank, 2016). According to the bank’s 2017 annual report (African Development Bank, 2017b), 540 MW of power capacity and 41 MW of renewable power capacity were installed in 2016. In addition, 2830 km of new or improved power and distribution lines were delivered, and more than 650,000 households had new or improved electricity connections. Furthermore, in 2017, AfDB invested in power-generating projects with a cumulative 1,400 MW exclusively from renewables under the New Deal on Energy (African Development Bank, 2017a).

Africa-European Union (EU) Energy Partnership (AEEP)

AEEP is part of the partnerships established under the Joint Africa-EU Strategy framework for cooperation between the two continents. The AEEP in 2010 agreed to meet the following targets by 2020: provide 100 million people with access to modern and sustainable energy services; double the generation capacity of cross-border electricity interconnections; and build a total of 15.5 GW capacity of hydro, wind, and solar while tripling the capacity of geothermal and modern biomass (Africa-EU Energy Partnership, 2016). According to the AEEP annual report, 500 MW of solar, 2132 MW of wind, and 2,174 MW of hydropower were added between 2010 and 2016 (Africa-EU Energy Partnership, 2016).

Energy Africa Campaign

The Energy Africa campaign, launched in 2015 by UK’s Department for International Development, is to support the UN’s seventh sustainable development goal of reaching universal energy access to households in Africa by 2030 with focus on market-based delivery of off-grid energy. The initiative aims to overcome financial hurdles; overcome policy and regulatory barriers; raise awareness; and market exciting, innovative research and development in the emerging solar market in Africa. Currently, about 11 countries have signed partnership agreements with Energy Africa.

PIDA and APV

PIDA was launched in 2010 and was adopted by all African Heads of State and Government in 2012 as a strategic continental initiative for mobilizing resources to build regional infrastructure (African Union Commission, 2012; NEPAD Agency, 2016, 2017). The PIDA Priority Action Plan has about 15 transformational energy projects estimated at $40.3 billion aimed at significantly scaling up the power sector across regions in Africa. The PIDA energy infrastructure portfolio regarding generation capacity calls for the development of major hydroelectric projects. Some of the major projects include the Great Millennium Renaissance Dam, Inga III hydro, the North-South Power Transmission Corridor, the Zambia-Tanzania-Kenya power transmission line, Central African Interconnection, and Batoka Gorge (African Union Commission, 2010). It is estimated that full implementation of the identified projects will provide access to about 800 million more people by 2040 (African Union Commission, 2010). The APV initiative builds on the objectives of PIDA to prioritize the implementation of energy infrastructure projects across Africa (New Partnership for Africa’s Development (NEPAD), 2015). The APV has a five-pillar strategy: (1) leverage domestic energy resources, (2) drive GDP growth with electrification, (3) scale up through regional integration, (4) run assets efficiently, and (5) mobilize all available resources. The goal of APV is to achieve an 80 percent residential electrification rate by 2040 and 90 percent for industry and business, while also implementing off-grid solutions and making full usage of the vast renewable energy resources in Africa. Currently, the initiative has identified 13 projects: one wind project (Boulenouar Wind Power), one solar project (Desertec Sahara Solar), one geothermal project (Baringo-Silali Geothermal Field), three hydro projects (Batoka Gorge, Inga III Basse Chute, Sambangalou), three gas projects, one gas pipeline, and three transmission lines.

Progress on Electrification in SSA

Access to electricity in SSA has been increasing slowly over the years. Statistics from the World Bank, SEforALL database, and IEA indicate that access levels progressed from 16.0 percent in 1990 to 43.0 percent in 2016 (World Bank, 2016a). From 1990 to 2010, the electrification rate increased by 16.7 percentage points (pp), which translates to a yearly increase of about 0.83 pp. Between 2010 and 2016, though, the access rate increased by 10.2 pp, equal to an annual percentage point increase of 1.7. In other words, the recent pace of electrification across the SSA region is twice the historical rate. Assessment of country-by-country progress showed significant variation in the electrification rates. In 1990, only four countries (Gabon, Djibouti, South Africa, and Equatorial Guinea) and two island nations (Mauritius and Seychelles) out of 49 countries in SSA had access levels above 50 percent. Of the remaining 43 nations, 33 had access levels less than 20 percent. By 2010, the number of countries with access levels less than 50 percent had decreased from 43 to 36, and of those, 19 countries had access levels less than 20 percent. And in 2016, 32 countries had less than 50 percent access level, and 12 of those were at 20 percent or less.

The population area chart in Figure 4 shows the distribution of people with and without access to electricity between 1990 and 2016. The analysis indicates that about 204.6 million people gained access between 1990 and 2010; however, the number of people without access grew from 430.5 million to about 591.0 million. The population of SSA grew by an average of 18.3 million people annually within that same period (World Bank, 2016a), implying that for every 10.2 million people that gained access each year, an additional 8.0 million people were added to the access deficit each year. Thus, the electrification rate for SSA between 1990 and 2010 did not outpace population growth enough, and as a result, the number of people without access continued to increase.

By comparison, about 155.9 million people gained access between 2010 and 2016, while the population without access did not appreciably increase. In fact, for the first time, the electrification rate was significant enough to outpace population growth, particularly in 2016. As a result, the number of people without access began to decrease. Overall, about 26 million people gained access each year from 2010 to 2016, compared with the 10.2 million that gained access yearly within 1990–2010. This observation reflects the significant progress made in 2016 as the electricity access level for the subcontinent reached 43 percent. The progress can be attributed to momentous annual electrification rate increases (5–14 percentage points per year) seen particularly in Kenya, Ethiopia, Tanzania, and Rwanda. Clearly, strong efforts were made in East Africa between 2014 and 2016 compared with the rest of the region.

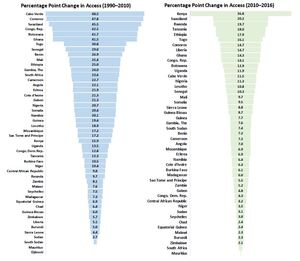

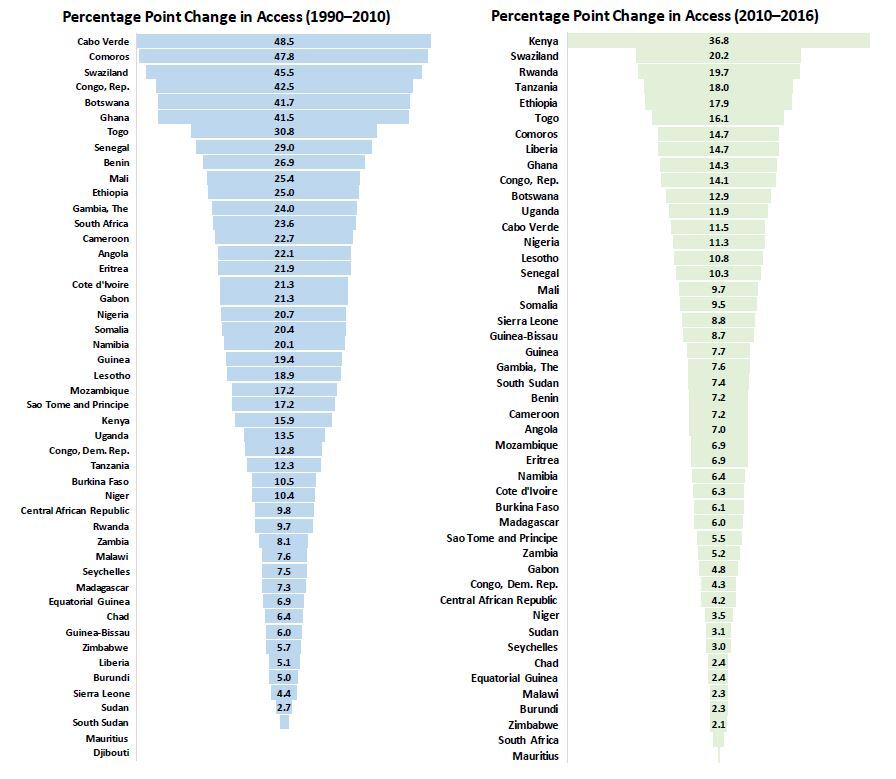

The funnel chart in Figure 5 contrasts individual countries’ percentage point change in electricity access between 1990 and 2010 with 2010 and 2016. Countries that made significant gains during the 2-decade period include Swaziland, the Republic of Congo, Botswana, Ghana, Togo, Senegal, Benin, and Mali. From 2010 and 2016, countries like Kenya, Swaziland, Rwanda, Tanzania, Ethiopia, Togo, Liberia, and Ghana showed substantial progress with annual percentage point increases of 2.0–6.2 per year, which is well above the region’s average percentage point increase of 1.7. In contrast, some highly populated countries such as the Democratic Republic of the Congo (DR Congo), Angola, Madagascar, Cameroon, Niger, Malawi, and Burkina Faso made minimal progress; their electricity access increased by 10 percentage points or less within those 6 years. Altogether, 27 counties made negligible progress (< 1 pp increase per year) or even declined in electricity access.

Figure 6 shows the breakdown of the population of SSA without access to electricity as of 2016. The Sankey diagram was based on the latest access data reported in the World Bank’s Development Indicators Database (World Bank, 2016b). Analysis of the data with respect to population indicate that about 589 million people in SSA lacked access to electricity in 2016. Most of the people without access were concentrated in the Eastern (230.6 million) and Western (173 million) regions of Africa. Comparably, 94.5 million and 81.3 million people lacked electricity access in the Central and Other Southern regions, respectively. Moreover, 78 percent of the population without access were living in only 18 of the 50 countries on the subcontinent. The 10 countries with the most people without access are Nigeria, DR Congo, Ethiopia, Tanzania, Uganda, Sudan, Mozambique, Madagascar, Niger, and Kenya.

Certainly, specific high-impact countries in the Western, Central, and Eastern parts of the region will have to increase electrification at a much faster annual rate to ensure universal access to electricity by 2030. Assuming the subcontinent continues to electrify at the pace observed between 2010 and 2016 (an annual average of 1.8 percentage points), 100 percent access to electricity across the SSA region will not be achieved until 2048. According to IEA New Policies scenario modeling (assuming the current national targets, investment commitments, and grid extensions plans are fulfilled), in 2030, there will still be about 600 million people without access living in SSA, the same as today (IEA, 2017b).

In a nutshell, the rate of electrification in SSA is still low, but it is likely to improve significantly in the coming years. To achieve 100 percent accessibility across SSA by 2030, the electrification rate would have to increase each year by an average of 4.1 percentage points from the access level in 2016.

Total Installed Generation Capacity

The lack of sufficient installed power generation capacity, as well as inefficient transmission and distribution infrastructure, deprive more than half of the region’s population of access to electricity while limiting the consumption of needed power for basic activities of everyday life, agricultural mechanization, industrialization, and business growth. Besides, for many SSA countries, the operational capacity could be substantially less than the installed capacity because of poor maintenance (International Energy Association [IEA], 2014). In addition, in many cities and urban parts of the subcontinent common power outages and load shedding characterize the unstable, unreliable electricity supply.

The region’s power-generating capacity has expanded gradually, as presented in Figure 7. The historical data from the US Energy Information Administration (US Energy Information Administration, 2015a) indicate that the total installed capacity for 49 countries in the SSA increased from 57.9 GW in 1990 to 95.9 GW in 2015. Excluding South Africa, the total capacity for 48 countries increased from 24.1 GW in 1990 to 48.6 GW by 2015. Eight of these countries had between 2 and 4 GW of capacity, 5 others had 1–2 GW power systems, another 8 had 0.5–1 GW, and the remaining 26 countries had less than 0.5 GW of capacity each (US Energy Information Administration, 2015a). In general, the subcontinent’s installed capacity as of 2015 (1.53 percent) was a negligible percentage of the world’s installed capacity (6281 GW) in spite of the fact the region accounts for more than 14 percent of the world’s population (Africa Progress Panel, 2015). In other words, the installed capacity for the subcontinent of more than 1 billion people is comparable to installed capacities in countries like South Korea (103 GW for 51 million people) and the United Kingdom (95 GW 65.1 million people).

The quickest installed capacity expansion occurred between 2005 and 2015 at a steady average annual increment of 2.43 GW. Of the 24.3 GW of new generation capacity, 8292 MW (34.1 percent) was in West Africa, 6883 MW (28.3 percent) was in East Africa, 5185 MW (21.4 percent) was in South Africa, 2246 MW (9.3 percent) was in Other Southern Africa, and 1684 MW (7.0 percent) was in Central Africa. In West Africa, the major countries contributing to the capacity expansion were Nigeria, Ghana, Côte d’Ivoire, and Guinea; in East Africa, Sudan, Kenya, and Ethiopia; in Southern Africa, Angola, Zambia, and South Africa; and in Central, Cameroon, and the Republic of Congo. In general, most of the countries in SSA have very low installed capacity per capita. In 2015, the installed capacity per capita across the region varied from as low as 6.73 W in South Sudan to as high as 860 W in South Africa.

Overall, the installed generation capacity is low; at least 39 countries from the subcontinent had less than 150 W of installed capacity per capita (US Energy Information Administration, 2015a). In comparison, the per capita installed capacity for the US was about 3346 W per capita in 2015.

Renewable Energy Installed Capacity

The total renewable energy installed capacity (excluding pumped storage) for the African continent in 2016 was at 38.3 GW, of which 81.7 percent (31.3 GW) was in SSA. The trend chart in Figure 8 shows the growth progression for renewable energy installed capacity in SSA. There was no significant change from 1990 through 2008. Most of the growth occurred between 2010 and 2016, when the capacity increased from 21.6 GW in to 31.3 GW. Until 2000, hydropower was the only installed renewable energy technology. However, because the cost of other renewable energy technologies has plummeted, and their installation is on the rise, the share of hydropower in the renewable electricity capacity mix has consequently lowered. As of 2016, the shares of installed capacity for hydropower, solar, wind, biopower, and geothermal were 79.1 percent, 7.7 percent, 6.1 percent, 3.5 percent, and 3.6 percent, respectively. It is worth pointing out that about 80 percent of the new installed capacity between 2010 and 2016 in SSA were from only six countries (South Africa, 32.9 percent; Ethiopia, 24.1 percent; Kenya, 10.6 percent; Zambia, 5.1 percent; Ghana, 4.4 percent; and Uganda, 3.3 percent).

In South Africa, the installed RE capacity was 803 MW, mainly hydropower and biopower. Capacity did not significantly grow from 2000 to 2012; the dramatic growth was between 2012 and 2016, when the capacity increased from 903 MW to 4069 MW. The increase in capacity was primarily due to solar photovoltaic, onshore wind, and concentrated solar power installations. In the case of Ethiopia, the installed renewable capacity was at 356 MW in 2000, but by 2009, it had increased to 694 MW. The country saw major growth in 2010, when total installation nearly tripled to 1875 MW. Capacity then increased slowly to 2342 MW in 2015 because of the installation of onshore wind energy. Finally, the capacity almost doubled in 2016 to a total installed capacity of 4228 MW, the result of additional hydropower installation. Installation of renewables in Kenya increased marginally from 770 MW in 2000 to 905 MW in 2008. By 2013, the capacity had expanded to 1115 MW. Since 2013, renewable capacity has expanded at an exponential rate because of geothermal energy. The total capacity as of 2016 was 2079 MW, which consisted of 53.7 percent geothermal, 38.6 percent hydropower, 4.3 percent biomass-based power, and the remaining capacity was for solar and wind. In Zambia, the renewable capacity is primarily hydropower; between 2000 and 2013, the total capacity increased from 1802 MW to 1944 MW. By 2016, the installed generation capacity had reached 2434 MW. Similarly, hydropower is the main renewable installed capacity in Ghana; the total capacity in 2016 was 1608 MW, compared with 1072 MW in 2000. In Uganda, the installed capacity almost tripled from 276.4 MW in 2000 to 810 MW in 2016. The installed capacity is primarily hydropower, but biopower has also been increasing; the country’s biopower capacity is currently at about 81 MW, compared with 16 MW in 2000.

It is worth pointing out that other countries, including Angola, Sudan, and Réunion, made some progress. For Angola, hydropower is the main installed renewable power. The capacity increased from 232 MW in 2000 to 964 MW in 2016. Sudan’s renewables capacity increased from 387 MW in 2000 to 430 MW in 2008 with primarily hydropower and biopower technologies. In 2009, the hydropower capacity increased significantly, by 1250 MW, and the total capacity stood at 1680 MW through 2011. Additional biomass power capacity (104 MW) and solar photovoltaic installation (9 MW) increased the total capacity to 1793 MW in 2016. Réunion also made progress in the installation of renewables; the total capacity expanded from 143.6 MW in 2000 to 381 MW in 2016. The increase was largely due to solar photovoltaic. The current RE installed capacity mix is 49 percent solar, 35 percent hydropower, 11.9 percent biomass-based, and 3.9 percent wind. Of note, other SSA countries, like DR Congo, Mozambique, Nigeria, Cameron, and Côte d’Ivoire, who had relatively high installed renewable capacity—primarily hydropower—did not expand their capacity between 2000 and 2016.

Total Electricity Net Generation

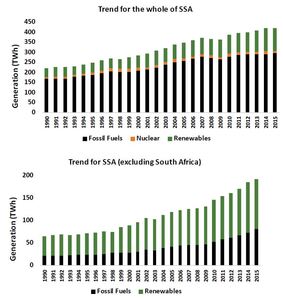

The electricity net generation for SSA in 2015 was about 422 TWh, with South Africa accounting for 55 percent of production. As shown in Figure 9, the net electricity generation increased from 221 TWh in 1990 to 422 TWh in 2015 at an annual average growth rate of 2.63 percent. Excluding South Africa, the average annual growth rate over the 25 years for the subcontinent was much higher (4.46 percent); the generation increased from 65.3 TWh in 1990 to 191 TWh in 2015. Regionally, Central Africa had the least growth in electricity generation on the subcontinent between 1990 and 2015; generation increased from 10.1 TWh to 20.4 TWh at an annual average rate of 3.0 percent, with DR Congo and Cameroon contributing more than 70 percent of the generation. In East Africa, the total net electricity generation increased from 11.0 TWh in 1990 to 48.2 TWh in 2015, reflecting an annual average growth rate of 6.1 percent. Ethiopia, Sudan, Kenya, and Tanzania contributed considerably to the growth. In West Africa, electricity production increased at an average annual rate of 4.1 percent from 22.9 TWh to 60.4 TWh within that same period; the major contributing countries were Nigeria, Ghana, and Côte d’Ivoire. For the remaining countries in Southern Africa, their total electricity generation grew from 21.3 TWh to 62.1 TWh at an annual rate of 4.6 percent, with most of the production coming from Mozambique, Zambia, Angola, and Zimbabwe.

The contrast between the periods of 1990–2010 and 2010–2015 indicates that the annual growth in SSA electricity generation (excluding South Africa) doubled in recent years. Between 1990 and 2010, the generation grew on average by 4.0 TWh per year (an increase from 65.3 TWh to 145.6 TWh in 20 years). By contrast, between 2010 and 2015, the generation increased from 145.6 TWh to 191.1 TWh in 5 years, an average growth of 9.1 TWh per year.

The Share of Renewable Electricity in Generation

Fossil fuels continue to be the main source for power generation in SSA, with South Africa leading the continent in power generation from coal. However, electricity production from renewable sources has been gradually increasing over the years. Between 1990 and 2015, renewable electricity generation increased from 44.75 TWh to 116.4 TWh (Figure 10). The share of renewables also increased, from 20.2 percent to 27.5 percent. The upward trend in the overall share of renewable electricity for the continent is primarily driven by substantial deployment of renewable energy technology in South Africa.

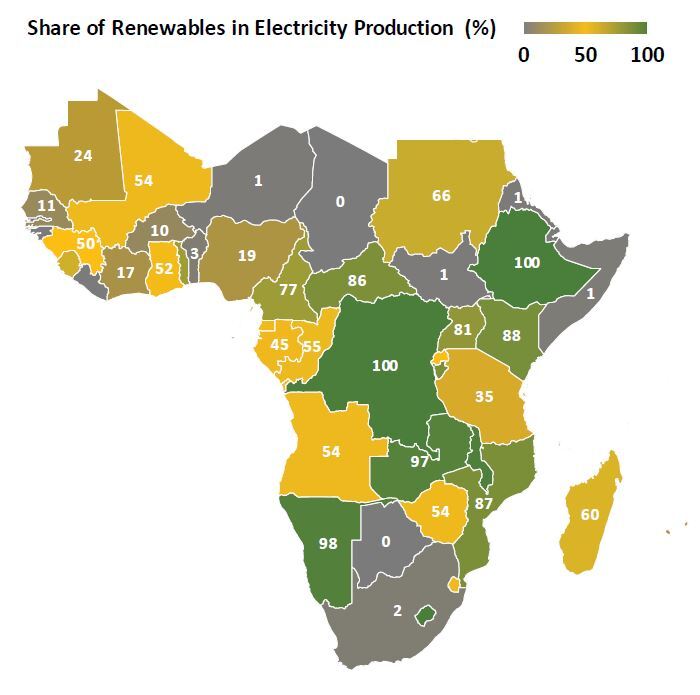

When the analysis on RE generation is performed without South Africa, however, the outlook is different (Figure 11). As shown in the charts, if South Africa is excluded from the analysis, the share of renewables in the generation mix for SSA has been declining. In 1990, renewable electricity accounted for 67 percent of the total generation, but by 2015, the share had reached 58 percent even though the gross generation from renewables had grown. Moreover, in 1990, 12 countries on the subcontinent had more than 90 percent of their generation from renewables, but by 2010, the number had fallen to 8, and in 2015, the number decreased further to 6. The map in Figure 12 details the share of renewables in electricity generation for each SSA country as of 2015. Overall, 10 countries had more than 85 percent of their generation from renewables, and of them, Ethiopia and DR Congo were 100 percent dependent on renewables. Fourteen countries obtained between 50 and 85 percent of their electricity from renewable sources, and about 20 nations obtained less than 20 percent from renewable sources. Some of the countries with a low share of renewables include Chad (0 percent), Botswana (0.0 percent), South Sudan (0.6 percent), Niger (0.8 percent), South Africa (2.4 percent), Burkina Faso (9.9 percent), Côte d’Ivoire (17.5 percent), and Nigeria (19.0 percent).

The growth in solar, wind, and geothermal is impacting the RE generation mix as expected. For instance, in 2010, the shares of hydro, solar, wind, geothermal, and biopower in the renewables mix were 96 percent, 0.2 percent, 0.1 percent, 1.5 percent, and 2.3 percent, respectively. By 2015, the shares of hydro, solar, wind geothermal, and biopower had changed to 88.4 percent, 2.8 percent, 2.8 percent, 3.6 percent, and 2.3 percent. Electricity generation from wind and solar increased exponentially within that 5 years; wind power generation increased from 72 GWh to 3.4 TWh, and solar power generation increased from 216 GWh to 3.3 TWh. Geothermal generation grew considerably as well, from 1.2 TWh to 4.2 TWh. Currently, South Africa leads the subcontinent in non-hydroelectric power generation, particularly wind and solar. In 2015, more than 75 percent of the total generation from wind and solar came from South Africa. Kenya currently dominates geothermal power generation. For biopower, more than 85 percent of the generation is from 6 countries (Mauritius, South Africa, Swaziland, Uganda, Réunion, and Kenya). About 80 percent of the hydropower is from 10 countries (Mozambique, Zambia, Ethiopia, DR Congo, Sudan, Ghana, Angola, Nigeria, Zimbabwe, and Cameroon).

Overall, hydropower continues to dominate the renewable electricity generation mix, but, its share has been declining gradually because of the installation of solar, wind, geothermal, and biopower capacities as the cost of these technologies continues to decrease and become more and more viable. However, even though the gross generation from renewables keep growing, the share of renewables in the generation mix for SSA (excluding South Africa) has been declining.

Electricity Consumption Levels in SSA

According to US Energy Information Administration data, the total electricity consumption for the entire SSA subcontinent was 374 TWh in 2015, representing nearly 1.8 percent of the world’s total consumption of 21,153 TWh. Excluding South Africa, the remaining SSA countries consumed 164.7 TWh total, less than 0.8 percent of the world total power consumption. The historical plot of annual consumption of electricity for SSA between 1990 and 2015 in Figure 13 shows a gradual increase in the total consumption from 202.5 TWh to 374 TWh. Excluding South Africa, the electricity consumption increased from 57.8 TWh to 164.7 TWh. The analysis shows that electricity consumption (excluding South Africa) increased by 3.4 TWh per year between 1990 and 2010 and 7.8 TWh per year between 2010 and 2015. It is worth noting that, between 2010 and 2015, SSA (excluding South Africa) recorded the highest annual growth rate of electricity consumption(6.3 percent) in Africa compared with 3.8 percent in North Africa and 0.4 percent in South Africa.

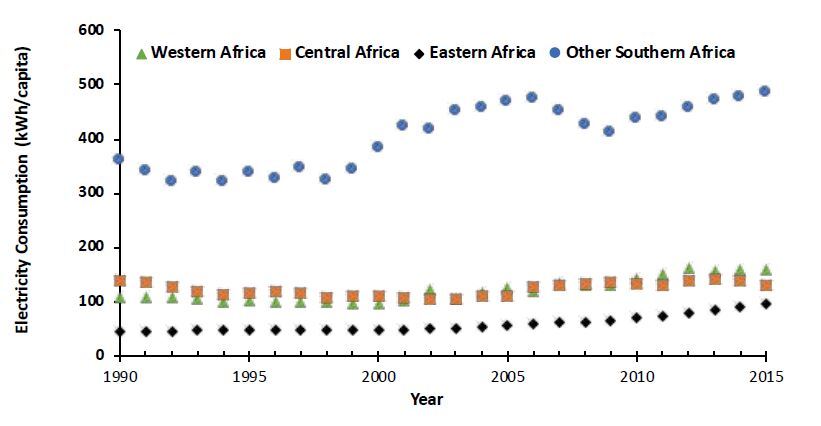

In spite of the recent progress in electricity consumption, estimation of the annual gross consumption per capita based on UN population data (United Nations, 2017) shows severe energy poverty in SSA. The annual gross average per capita electricity consumption in SSA, based on the estimates, excluding South Africa, was approximately 171 kWh in 2015. The analysis further showed that the annual gross electric power consumption per capita within the subcontinent varied widely from region to region and country to country. For example, the 2015 data indicated that the average gross electricity consumption per capita for the Western, Central, Eastern, and Southern (without South Africa) regions were 157 kWh, 131 kWh, 96 kWh, and 487 kWh respectively. Notably, these levels were significantly lower than the consumption level in South Africa (3783 kWh per capita). The regional estimation of gross annual electricity per capita in SSA in Figure 14 indicates barely any growth in SSA between 1990 and 2000. Major growth in consumption was observed between 2000 and 2006 in southern nations, particularly in Mozambique, Angola, and Namibia. The Eastern region had significant increase in per capita electricity consumption between 2010 and 2015, with an average annual growth rate of 7.6 percent; the annual average per capita gross consumption increased from 69.8 kWh to 96.4 kWh. By contrast, there was no growth in Central Africa. Overall, the consumption level in SSA has been low for many years, but it appears to be increasing in recent years.

The study estimated the annual household electricity consumption for each SSA country population with access to electricity in 2015. A residential electricity consumption of about 35 percent of the total consumption and a household of 5 people was assumed. The analysis indicated that the national average annual electricity consumption per household in SSA varied from 142 kWh to 7742 kWh. About 62 percent of the countries in SSA had a national average of less than 1000 kWh consumed per household in 2015, as shown by the radar chart in Figure 15. South Africa (7742 kWh), Seychelles (6043 kWh), Namibia (5366 kWh), Botswana (5040 kWh), and Zambia (4061 kWh) had high national average electricity consumption per household. At the other extreme, Guinea-Bissau (223 kWh), Somalia (143 kWh), Sierra Leone (239 kWh), and Chad (324 kWh) had extremely low consumption per household.

According to the Multi-Tier Framework (MTF) developed by the Energy Sector Management Assistance Program under SEforALL initiative, most of the SSA population with electricity access had an average service level at Tier 3 (Bhatia & Angelou, 2015), as shown in Figure 16. The MTF reflects energy access with respect to capacity, duration of supply, reliability, quality, affordability, legality, and safety. A Tier 3 service level implies that enough electricity is available for multipoint lighting, phone charging, and use of appliances such as radios, televisions, computers and printers, fans, air coolers, refrigerators, food processors, and rice cookers. It is worth pointing out that the analysis presented in this research paper is a simplification of the MTF, as it presents a non-weighted national average of the annual household consumption.

The New Business Model for Electricity Access

Providing electricity access to rural areas has always been a challenge. The populations are typically dispersed, and many households have low income and no guarantee of the means to pay for energy services. In addition, the consumption levels in rural areas are relatively lower than in urban and peri-urban areas. These factors make it difficult for state-owned electricity providers to expand, as these providers struggle to maintain the power-sector infrastructure (generation capacity, transmission, and distribution), collect payments, and prevent illegal connections and theft. In addition, expanding a centralized grid system to remote areas is costly, and even the use of anything close to a cost-reflective tariff model might not be affordable to underprivileged citizens living in those remote areas.

The current challenge highlights the need to pursue all forms of electricity expansion solutions to accelerate the pace of electrification in SSA. Distributed renewable energy systems in comparison to the grid offer a much faster and affordable pathway to close the access gap in rural areas (Herscowitz, 2017; SEforALL, 2017c). The significant reduction in the cost of renewable energy technologies coupled with new energy business models and efficient appliances are making it possible for rural households to “leapfrog” the national grid just as mobile phones allowed millions in Africa some few years ago to “leapfrog” landlines. Today, mobile technology is enabling innovative business models for providing several services (GSMA, 2017). For example, people with mobile phones in Africa can send and receive money without an actual bank account using mobile money services like M-Pesa. Similarly, in rural areas, people with mobile phones and access to a cellular network are using off-grid energy systems like solar home systems through pay-as-you-go financing and payment schemes by major providers like Mobisol, M-Kopa, BBOXX, and Off-Grid Electric (GSMA, 2017). In addition, there are key market-building programs like SunnyMoney, Ignite Power, and Lighting Africa (now Lighting Global) in the region.

Importantly, decentralized technologies hold the key to closing the electricity divide in SSA. In an Energy for All Case scenario modeling for SSA, more than 80 percent of the needed capacity to provide universal access is projected to come from decentralized technologies (both off-grid and mini-grid systems); the total additional generation capacity has been estimated to be at 87 GW, which consists of 15 GW of grid-based capacity, 40 GW of mini-grid capacity, and 32 GW of off-grid capacity (IEA, 2017a). Hence, the use of off-grid systems, including mini-grids, standalone systems, and other community-driven approaches should be made a priority in national and local power system planning to accelerate the pace of electrification.

Summary

There are signs of progress on scaling up SSA power infrastructure and increasing electricity access, particularly in the Eastern and Western sub-regions. The installed generation capacity is expanding; the average rate of expansion was at 2.43 GW per year between 2005 and 2015. RE power installation is also growing; about 9.7 GW of RE capacity was installed between 2010 and 2016. According to recent data, the net electricity generation in SSA in recent years has been increasing at 9.1 TWh per year, double the previous average growth of 4.02 TWh/year (1990–2010). Even though the gross generation from renewables keeps growing, the share of renewables in the generation mix for SSA (excluding South Africa) is declining (67 percent in 1990 to 58 percent in 2015). Using the MTF for energy access, it was estimated that about 58 percent of the countries in SSA had a non-weighted national average of household electricity consumption at the Tier 3 level, while 16 percent were at Tier 4 and 18 percent were at Tier 5.

Currently, electrification across the SSA region is more than twice the historical electrifying rates, and at least 26 million people are now gaining access to electricity yearly. Between 2010 and 2016, the access rate increased by an average of 1.7 percentage points annually, approximately double the rate of about 0.83 percentage points between 1990 and 2010. Nevertheless, progress is uneven across SSA. Between 1990 and 2010, countries like Swaziland, Botswana, Ghana, Togo, Senegal, Benin, and Mali made significant gains in electrification. More recently, Kenya, Rwanda, Tanzania, Ethiopia, and Liberia have been seriously undertaking electrification projects to expand access. Unfortunately, many other SSA countries, like DR Congo, Angola, Madagascar, Niger, Malawi, and Burkina Faso, are not pursuing bold steps to expand access to electric power. Between 2010 and 2016, 27 counties made negligible progress (< 1 percentage point increase in access per year) or even declined in electricity access because of population growth.

Table 4 summarizes 2015 electrification statistics of 20 selected countries. Among them are countries that are consistently making the necessary efforts to expand electricity access and other countries with poor energy access levels that are not doing enough to enhance electrification. The selected countries in the table are ranked according to access levels (from high to low).It can be inferred from the dataset that the installed capacity per capita has a direct correlation to electricity access, as shown in Figure 17. In general, across the sub-continent, installed capacity for 2015 varied from as low as 3.4 W per capita (Chad) to as high as 931 W per capita (Seychelles). It is worth pointing out that higher installed capacity does not automatically or directly equate to higher access. Other factors have a significant impact, such as availability/quality of the transmission and distribution infrastructure, especially in the case of grid-type access for densely populated urban areas. On average, it appears that an annual average of 120 W per capita could provide universal access to the countries on the chart in Figure 17. Interestingly, the residential tariff and the estimated annual electricity consumption per household does not correlate well with electricity access.

Kenya is currently leading the sub-Saharan region with respect to electrification rate. Between 2011 and 2016, the country’s access level increased from 29 percent to 56 percent, representing an annual average percentage point increase of 5.4. The Government of Kenya aims to reach 70 percent electrification by 2017 and universal access by 2020 (Government of Kenya–Ministry of Energy and Petroleum, 2017). Several energy policies (the 2004 Energy Policy and the 2006 Energy Act), regulations, generation reforms, and the Kenya Vision 2030 serve as the bedrock of the current electrification efforts and the general progress seen in Kenya’s energy sector (Government of Kenya–Ministry of Energy and Petroleum, 2015). In 2015, the World Bank approved $457.5 million for the Kenya Electricity Modernization Project to expand electricity access to low-income households and small businesses. Kenya’s electrification campaign encompasses installing of various generation capacities, expanding transmission/distribution network, and connecting households. Some of the major projects implemented include the “Last Mile” connection project and the Worlds Bank’s Global Partnership Output Based Aid.

Ghana is also one of the few countries in SSA that has steadily increased electricity access over the years. In 1990, only 23 percent of the population of Ghana had access, and by 2016, almost 80 percent of the population had access. The steady progress can be attributed to the National Electrification Scheme (NES), which was established in 1989 to provide universal electricity access by 2020. Another program, Self-Help Electrification Programme, was also established to support the NES. The programs have been implemented in phases under various projects with financial support from the World Bank (International Development Association), Danish International Agency, and the Japanese International Cooperation Agency. The NES program identified 4,200 communities with a population of at least 500 for electrification, and as of 2010, 4,132 had been connected to the national grid (Ministry of Energy (Ghana), 2010).

Swaziland also has made a significant effort over the years to improve electricity access. The Swazi nation barely had electricity access in 1990 (< 1 percent), but by 2000, the access rate had increased to 22.2 percent, and in 2016, about 66 percent of the population had access to electricity. The National Development Strategy, established in 1997, and the National Energy Policy, established in 2003, to some extent provided the platform for electrification. Specifically, the rural electrification policy set a goal to attain universal access by 2022.

Similarly, the government of Mali has been making consistent efforts to increase electricity access across the country. Their focus has been on rural electrification through the deployment of mini-grids, as almost 70 percent of the population lives in rural areas. In 2003, the Malian Agency for Development of Domestic Energy and Rural Electrification (AMADER) was created to implement decentralized rural electrification programs (Green Climate Fund (GCF), 2017). Mali has a firm policy and regulatory platform; for example, the National Energy Policy of 2006, the National Strategy for the Development of Renewable Energy (2006), and the National Energy Sector Policy Letter of 2009 (AfDB Group, 2015). The Mali’s goal is to achieve about 61 percent rural electrification by 2033 (AfDB Group, 2015). Reports show that rural electrification increased from less than 1 percent in the early 2000s to about 19 percent in 2016 (Green Climate Fund (GCF), 2017). In addition, the national access level increased from 10.3 percent to 35.1 percent between 2000 and 2016. In a nutshell, Mali is considered to have successfully implemented mini-grids; as of 2015, more than 160 standalone mini-grids had been installed under AMADER (AfDB Group, 2015; African Development Bank Group, 2017; Green Climate Fund (GCF), 2017; Walters et al., 2015).

It is worth pointing out that the countries highlighted above, including others like Cape Verde, Botswana, Togo, Senegal, and Ethiopia, are constantly making progress because of national electrification programs and infrastructure investments. On the other hand, many SSA countries with low access levels still lack aggressive national electrification policies and programs to expand the electricity infrastructure. In 2016, about 78 percent of the population without electricity access lived in only 18 out of the 49 countries in SSA. Prioritization of electricity planning with respect to infrastructure expansion (generation capacity and transmission/distribution network) is critical in countries like Nigeria, DR Congo, Tanzania, Uganda, Sudan, Mozambique, Madagascar, Niger, Angola, and Burkina Faso. The appropriate energy model based on each nation’s demographic resources and electricity demands must be well identified and understood for effective delivery of electricity access. Above all, accelerating electricity access in SSA requires concerted efforts by all the various governments in the sub-continent to mobilize the needed financial resources and catalyze private-sector investment into the energy sector. The enabling environment, including the appropriate legal, policy, and regulatory environment, needs to be created to support the financial resources required to boost growth in SSA’s power sector. The international and regional initiatives would also have to pay more attention to countries with very low access levels like Burundi, Chad, South Sudan, Malawi, the Central African Republic, and Guinea-Bissau.

Conclusions

Electrification in SSA is currently progressing at a higher rate than between 1990 and 2010, with East Africa registering significant gains. Nonetheless, the electrification rate would have to increase each year by an average of 4.1 percentage points from the access level in 2016 to achieve 100 percent electricity access across SSA by 2030. In other words, about 70 million people would have to gain access every year from 2017 to achieve universal access in 2030. If the sub-continent continues to electrify at the current average pace—an annual average increase of 1.7 percentage points, which was observed between 2010 and 2016—the SSA region will not have 100 percent access to electricity until 2048.

Bold actions are therefore needed to meet the targets set by the various initiatives. Ensuring universal access to electricity is an achievable objective so long as there is political will, an energy plan, enough financing, an enabling environment, the legal framework, and the appropriate business model to deliver energy services and electric access based on the demographic resources and needs. Historical trends from several countries suggest that reaching universal access could take up to 3 decades. (Bazilian et al., 2012). However, some countries, like Thailand, China, and Brazil, have demonstrated that universal access to electricity can be achieved in a shorter period—less than a decade in Thailand’s case.

A major barrier to accelerating electricity access in SSA is lack of investment. The current flow of public finance from multilateral and bilateral sources into SSA toward electrification is well below the needed investment. IEA estimates that $49.4 billion per year of annual investment is needed to completely power the SSA region by 2030 (IEA, 2017a). Other estimates indicate investment of US$55 billion per year is needed to achieve universal access to electricity by 2030 in SSA (Africa Progress Panel, 2015). Without foreign investments, SSA governments would have to commit 3.4 percent of GDP to power-sector infrastructure expenditure to attain universal energy access by 2030. A commitment of about 2 percent of GDP for new generation capacity, transmission, and distribution would achieve a roughly 70–80 percent electrification rate in SSA by 2040, which is a total of about $835 billion capital (Castellano et al., 2015a). In addition, if the current power sector is well-maintained and the utilities are managed without making a loss, then the funds ($21 billion per year on utility losses and energy subsidies) used to render the inefficient utilities functional could be redirected into productive infrastructure investment and growth. Furthermore, SSA governments could increase their revenue base and stop illicit financial flows to create the fiscal space to invest more in infrastructure development (Africa Progress Panel, 2015).In summary, it is important that the appropriate legal, policy, and regulatory environment is created to support the financial resources required to boost growth in SSA’s power sector (Banerjee et al., 2017).

Acknowledgments

This review paper was conducted as part of a professional development award to the author from RTI International.

_of_power_utilities_in_sub-saharan_africa_(ssa).jpg)

.jpg)

_without_a.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

_from_1990_to_2015.jpg)

_countries_at_various_average_national_multi-tier_framework_(mtf).jpg)

.jpg)

_of_power_utilities_in_sub-saharan_africa_(ssa).jpg)

.jpg)

_without_a.jpg)

.jpg)

.jpg)

.jpg)

.jpg)

_from_1990_to_2015.jpg)

_countries_at_various_average_national_multi-tier_framework_(mtf).jpg)

.jpg)